Jurong Port and the Lighter Terminals operate as separate cost centres. Hence, 1 to 3 separate credit accounts may be required:

- For Jurong Port: General Bulk / Container accounts

- For Lighter Terminals: Penjuru Lighter Terminal & Marina South Wharves accounts (both terminals share a single account number)

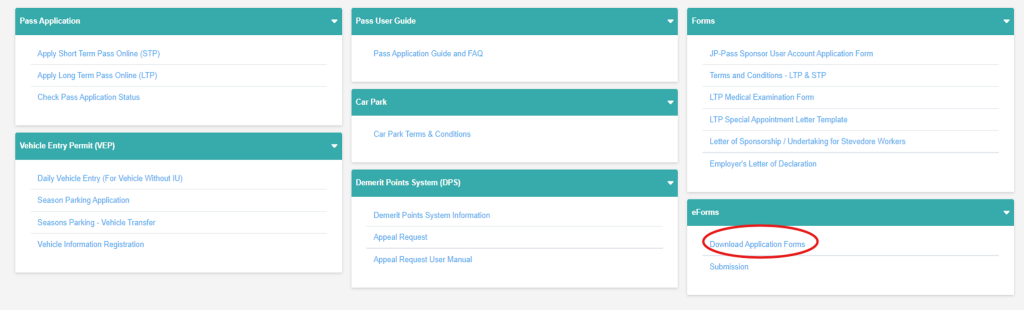

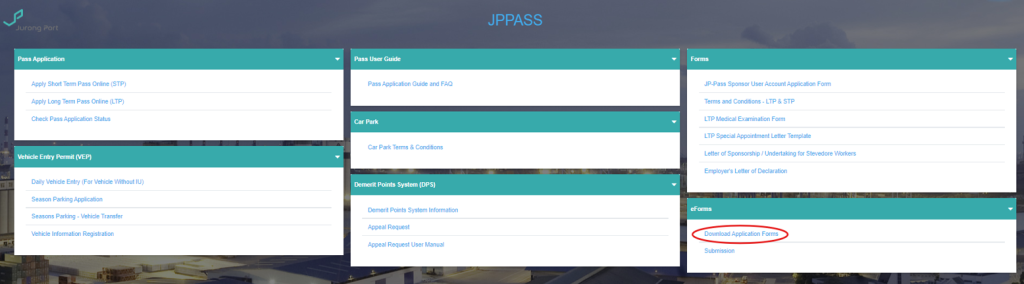

(1) Go to https://www.jurongportonline.com/JPPASS/

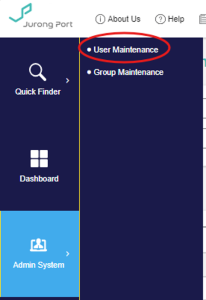

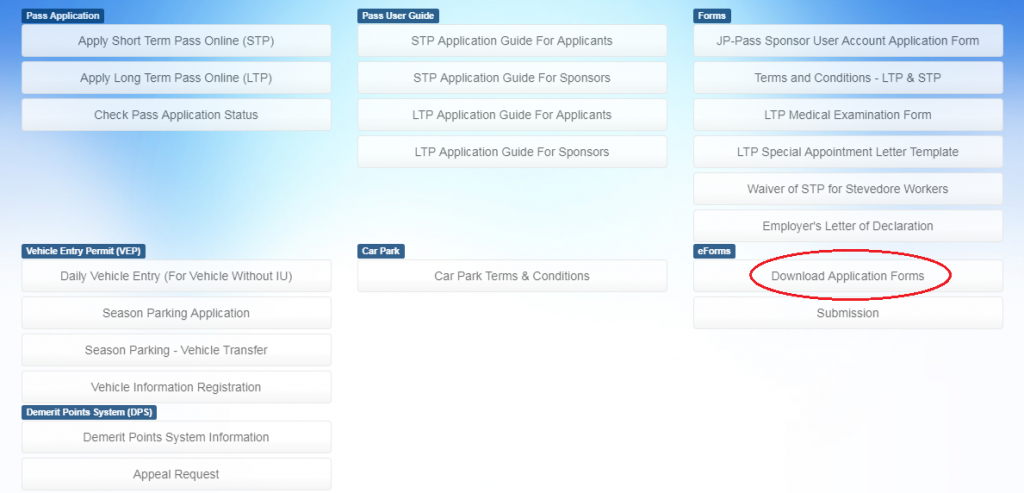

(2) Look for eForms

(3) Select Download Application Forms

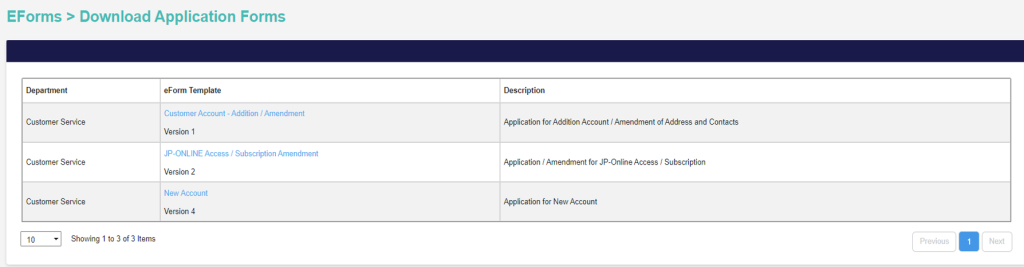

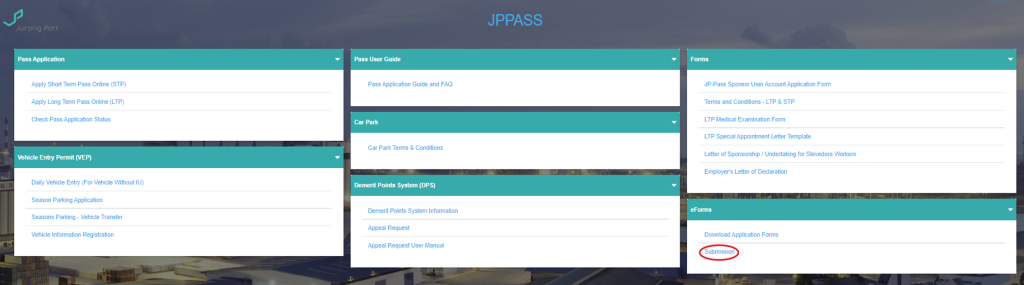

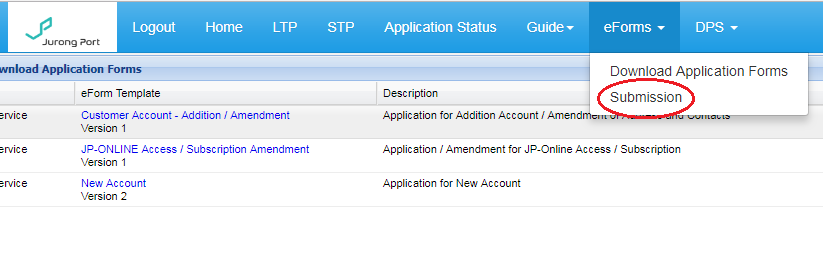

(4) Select New Account- Save file name as [ “Your Company Name”.pdf]

(5) Complete (new Credit Account application) page 1 only

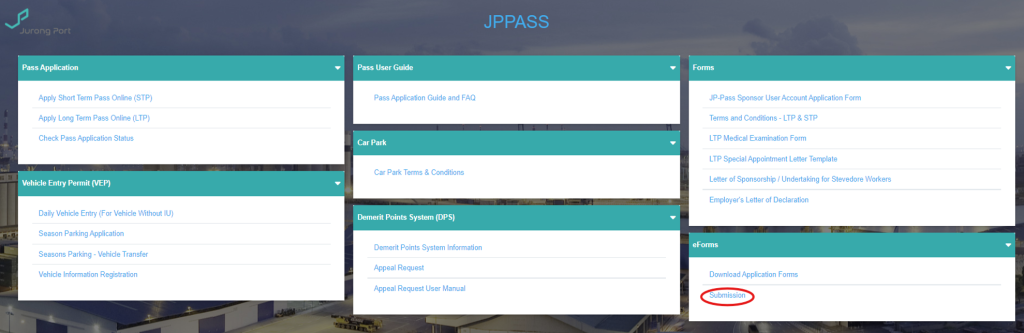

(6) After completing the form, look for “eForms” on the header tab & click

(7) Select Submission

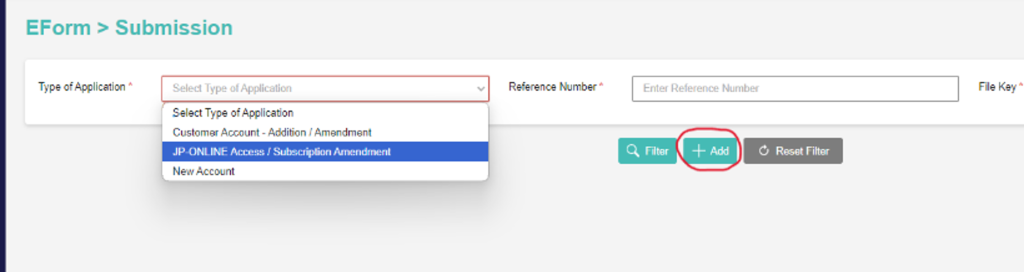

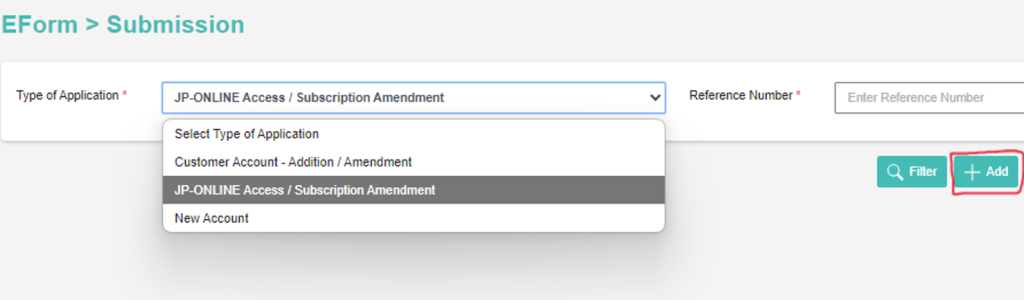

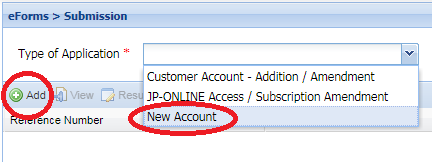

(8) Under “Type of Application”, select “New Account”

(9) Select Add

(10) Attach the following:

- Completed e-Form

- Latest company business profile (within 3 months from date of application)

- Audited/Unaudited Financial Statements for the past 2 financial years

- Latest Management Accounts signed by director

(11) Provide SMS & Email details

(12) Click Submit

Note: A Credit Account is a compulsory requirement to operate in Jurong Port, Penjuru Lighter Terminal and Marina South Wharves. The account generates the charges for operations carried out.

Once the application for the opening of the credit account has been approved, the credit review team will notify you to provide the following:

- GIRO application form

- Security deposit (Cheque, Bank Transfer or Original copy of endorsed banker’s guarantee)

The credit account will only be opened after the required documents have been received.

It can take up to 2 weeks or so from the date of receipt of the application if all required documents are received in order.

Please email a letter (with company letterhead) to our Finance Department at finar@jp.com.sg, requesting the closure of the account with the following information:

(1) Company Name

(2) JP Credit account number

(3) Date of Termination

(4) Reason for Closing Credit Account

(5) Letter must be fully signed and stamped with the official company stamp

(6) If there is a deposit, please state the mode of refund

For Non-GIRO customers: Please mail us the Direct Credit Authorisation form endorsed by the bank. This is to credit the security deposit back to the company bank account.

Note:

- The refund of the deposit is made after outstanding sums are recovered

- The duration taken for the actual crediting is about 1.5 to 2 months